Pros: Loan amounts up to $150,000. Discounted rates through PenFed's car buying service. Cons: Its standard APR rates aren't as attractive as rates some other credit unions offer. What to look for: PenFed Credit Union offers auto loan terms from 36 to 84 months on new vehicles with APRs from 5.24% to 7.29%.. Minimum loan amount $ 20,000 for 73-84 month term. Rate also depends on term. Loan Payment Example: A $20,000 new auto loan financed at 5.59 % APR would amount to 60 monthly payments of approximately $ 384.47 each. Used Auto Loans: Maximum used car loan advance will be determined by PenFed using a JD Power value.

5 Benefits of Securing a Car Loan from a Credit Union Kansas City Credit Union

Cloudy forecast for credit union auto lending in 2020 Credit Union Journal

CU Solutions Group How One Device Can Help Grow Your Credit Union’s Auto Loan Volume Car

Member First Credit Union Car Loan YouTube

6 Reasons To Get A Credit Union Car Loan

Tips from Teachers Credit Union buying a car Car buying, Credit union, Car

Credit Union Car Loans 1st Ed Credit Union

25+ Borrow 30000 over 5 years AmannKelvyn

Best Credit Union For Car Loan Near Me Loan Walls

Houston Credit Union Auto Loans

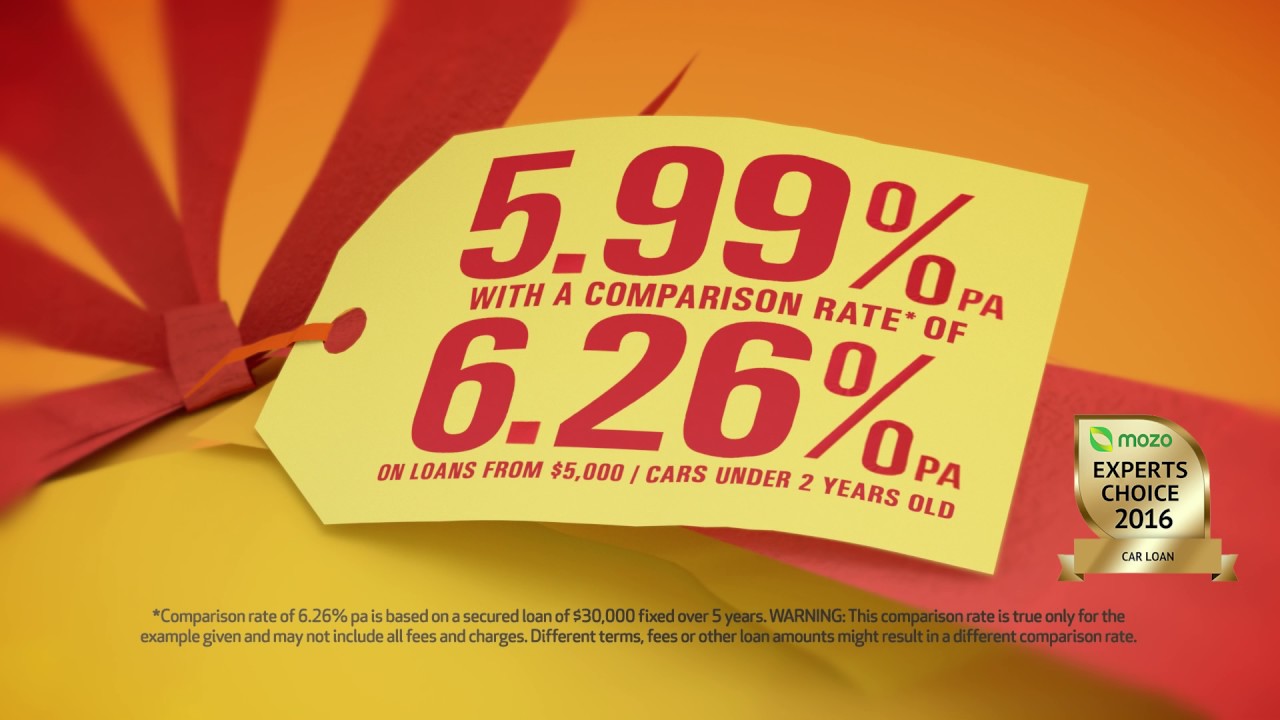

Credit Union SA Car Loan YouTube

Best Credit Unions for Car Loans of 2024

Qualifying for a Navy Federal Credit Union car loan as both a home owner and a renter at the

Credit Union Car Loan Rates Utah Navy Federal Credit Union Car Loan Reviews TBC Apply now

Safe Credit Union Car Loan Calculator NOALIS

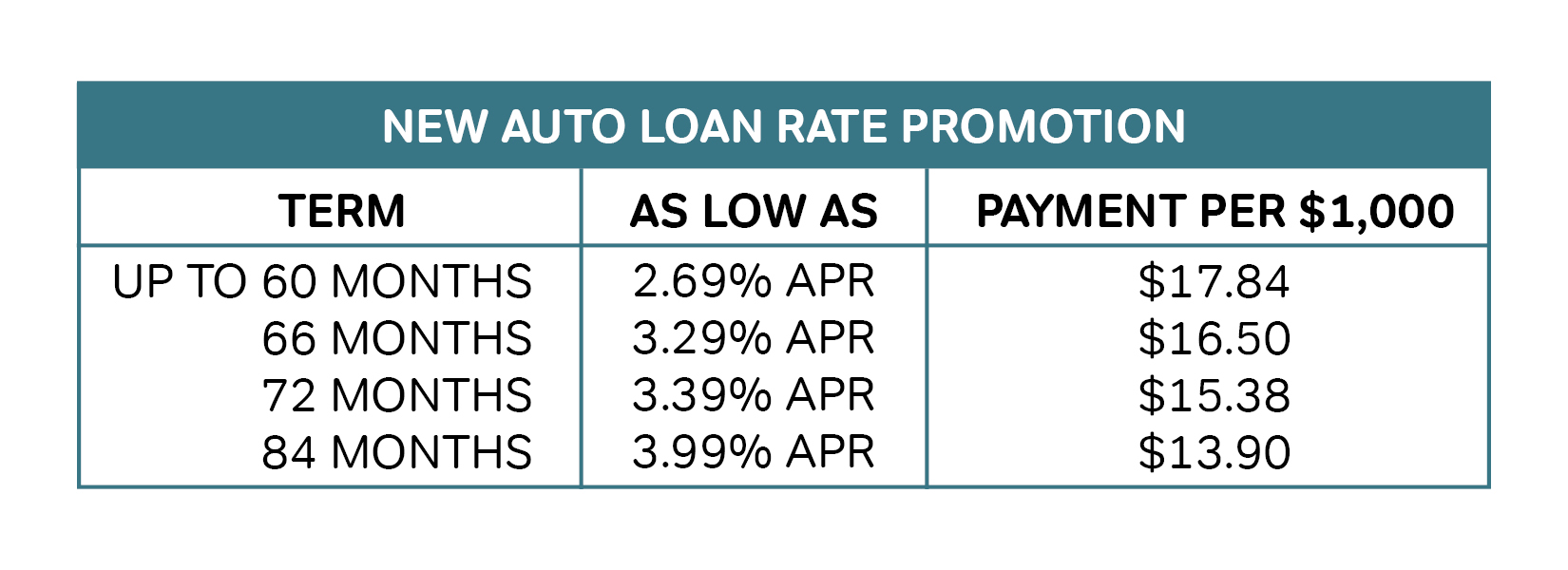

New Car Loan Rate Mulcair Credit Union Limited

Understanding Navy Federal Auto Loan Payment Options

WHY YOU SHOULD GET A CAR LOAN FROM A CREDIT UNION Vibewow

5 Benefits of Securing a Car Loan from a Credit Union Kansas City Credit Union

Credit Union Car Loans Alliant Credit Union

The most popular reason to get your car loan from a credit union is so you can pay a lower interest rate. You can pay a lower interest rate than you would through your bank or with the financing.. RTP Federal Credit Union. 4.99%. N/A. 120. Civic Federal Credit Union. 4.99%. 36. 96. Though these car loan rates aren't as good as the few zero-percent interest car deals offered by some new car.